How It Works

It’s actually pretty simple.

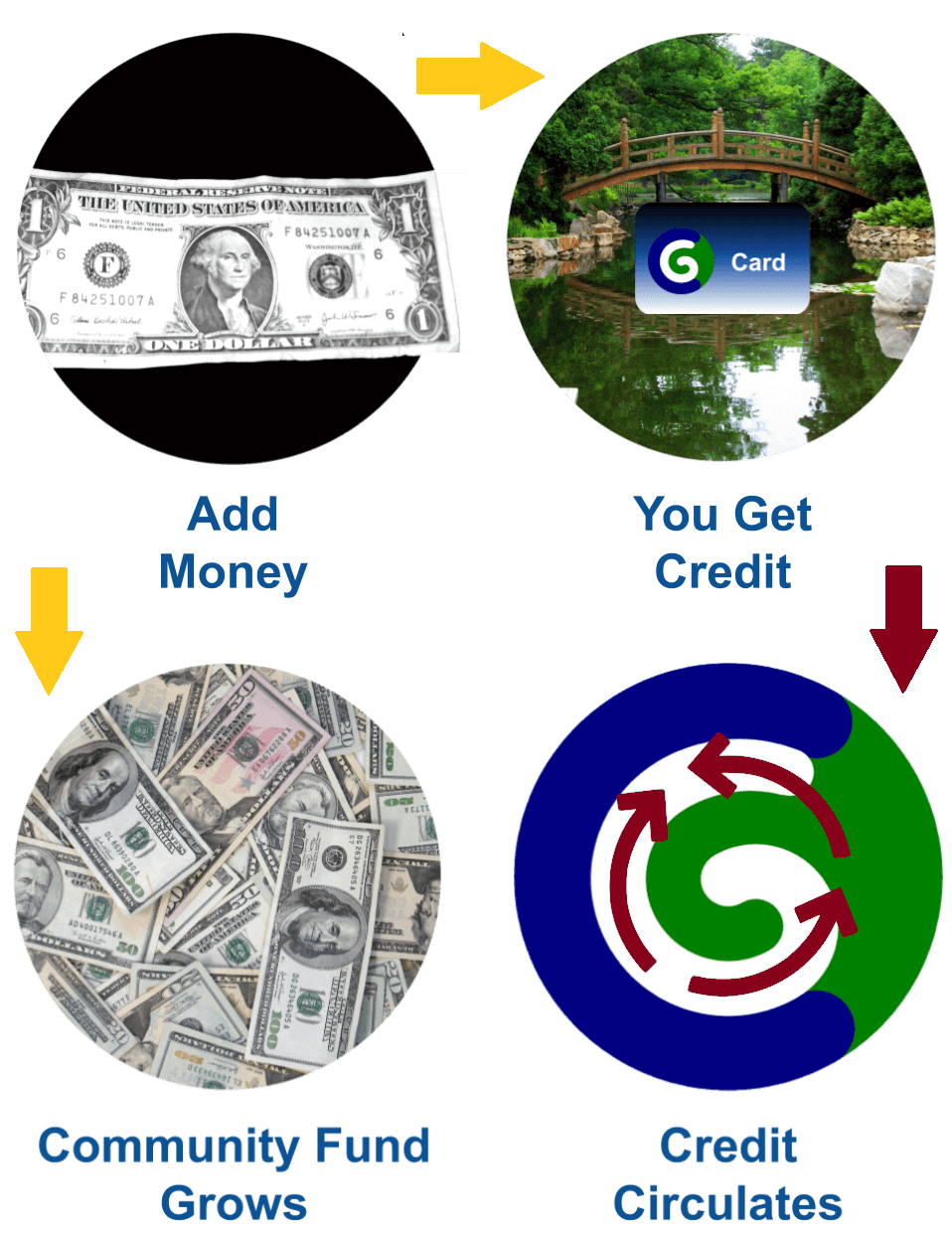

Put Money In. You Get Credit. When you put money on your Common Good card, the money goes into a Community Fund and you get that much credit to spend at a participating business or for person-to-person payments. The business uses our CGPay app to scan your card (or your phone, running CGPay) at no cost to either you or the business. No credit card fees!

Credit Circulates. The business can then use that credit to pay its employees and suppliers, employees spend it again at a participating business, and the credit goes in circles, in your community.

Community Fund Grows. Meanwhile, the money you put in from your bank account is still there in the Community Fund. That’s the “float”, representing the amount of credit being actively used, going in circles within the Common Good system. The Community Fund typically holds about $250 per member. With a thousand members, for example, that’s a quarter million dollars.

If you get more credit than you can easily spend within the Common Good system just transfer it to your bank account and the Community Fund goes down by that much.

As the amount in the Community Fund grows overall, we can invest it together, democratically, in worthwhile projects for the community and the common good. We can even make grants, backed by guarantees from supportive members.

FAQs for New Members

What does it cost?

It’s free for members — both individuals and businesses.

However, Common Good is a small nonprofit and will continue to depend on donations until we grow to scale. Most members choose to make a recurring contribution, typically $25 or $50 a year, but this is not required. Likewise many individual members choose Roundups and many business members choose Crumbs. We at Common Good appreciate your support enormously.

Where does the money for funding come from?

When you put money on your Common Good card from your bank account, that money goes into the Community Fund and the system gives you that much credit to spend at a participating business. While that credit circulates — going from one member to another within the Common Good system — more and more money accumulates in the Community Fund. The more Common Good credit that circulates, the more there is in the Community Fund.

Who determines which projects get funded?

You do! together with the other members in your community! Common Good Communities use sociocracy at in-person meetings and liquid democracy for online voting.

How is this any different from a Community Loan Fund?

Community Loan Funds are a great innovation and are one of the inspirations for the Common Good system. When you lend money to a Community Loan Fund good things happen in your community. Your money is then tied up for a few years — you can’t use it while the Community Loan Fund is using it.

But when you transfer funds to your Common Good Account, the Community Fund grows AND the money you put in is still available — you can still spend it. Cool, eh?

Even better, once your your community is confident it will use the Common Good system for a long time, you can make grants from the Common Fund, with guarantees from supportive members.

This is so awesome, why isn't everyone doing it?

Common Good is still pretty new, so it isn’t well-known yet. Also, it’s growing faster every day, so we don’t want to waste a lot of money on advertising. If you like Common Good, tell your friends!